Mirador Real Advice Blog

What is High Income and Comfortable Stability?

By Stan Clarke, March 2025

Mirador’s Income and Stability Fund and its related programs are named to convey their exact purpose and benefits to investors:

- High Income

- Comfortable Stability

What is High Income?

Well, like many things, it’s all relative. Here are some income yields for some typical saving and income investments:

All of these have a different level of volatility and hence provide a yield appropriate for that volatility. Statistically we can look at the average or median of the yields to get an idea of a typical income yield. In the case of the above examples, the average is around 4.2%.

The Mirador Canadian Income and Stability Fund started both 2024 and 2025 with a distribution yield of 7.5%. This is 78.6% higher than the average of the above-mentioned typical income investments. If that is not high income, then I don’t know what is! Yes, other investments out there might have a higher yield, but they will not likely have the same tax efficiency, liquidity, diversification, or a similar level of volatility compared to Mirador Income and Stability programs.

What is Stability?

According to Merriam Webster and Edge Copilot, stability is:

The strength to stand or endure – firmness. The property of a body that causes it, when disturbed from a condition of equilibrium or steady motion, to develop forces or moments that restore the original condition.

Stability does not imply the absence of movement or change. It means the resilience or defence to forces of change that allows something to have less change and remain closer to a steady state – and, if changed, restore itself to the original condition. With investing, many forces of change create volatility in our capital values – making them not totally stable. Some people call this risk.

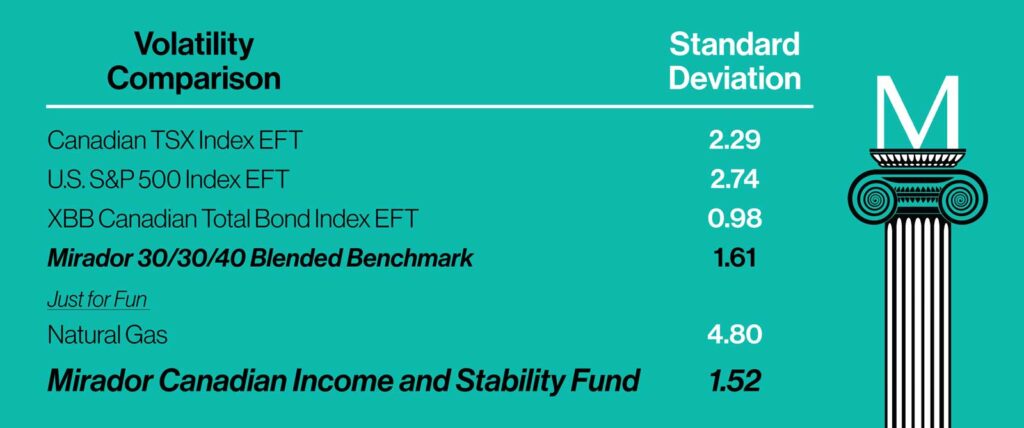

We need to endure some volatility in order to achieve the better yield. What’s most important is that the volatility you experience is appropriate for your time frame. This brings us back to the above comment on yields being appropriate to the volatility. If our yield is high at 7.5%, then is our volatility high? Again, it is a matter of relativity, so here are some volatility measures using the widely accepted measure of volatility known as standard deviation:

As you can see, we have a lower standard deviation than all of the above except bonds. But I should mention that the current drawdown for bonds is -15% – the bond index ETF is 15% lower than it was in 2021.

Here is something that nobody seems to talk about – an investment can have higher volatility (standard deviation), but if the volatility is all to the upside, then it doesn’t matter – it wasn’t risk, it was just excitement! So, for investors it is important to use other measures of risk and volatility. The most important is drawdown, which is the percentage that an investment drops from its highest point. This is extremely important because this is what causes the most discomfort for investors.

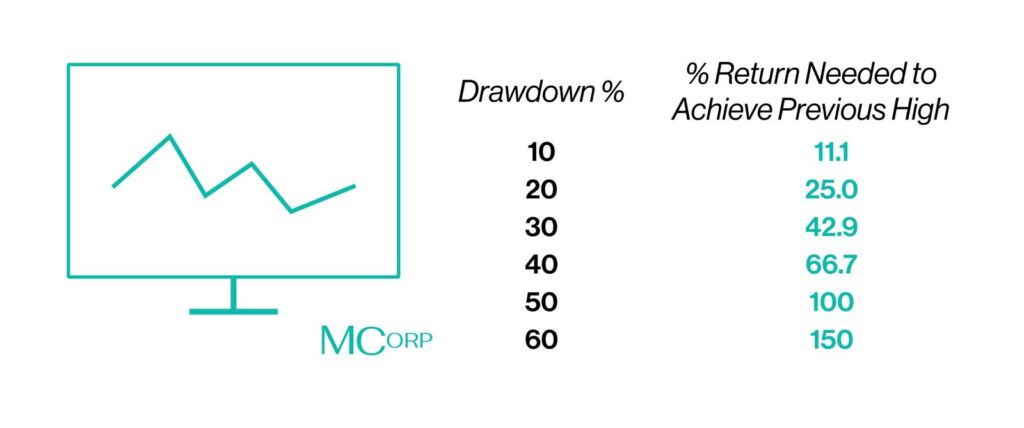

Also, drawdown causes some investment math problems. First, it can devastate your long-term capital value if you withdraw capital during a period of drawdown, especially if the drawdown is significant. This is because you have less capital to participate in the recovery. So, just in case a client might need to dip into their capital, we do our best to minimize drawdown.

Second, the returns needed to recover from a drawdown make it clear that for long-term capital STABILITY, you need to reduce drawdown:

Now, here is a “historic” fact about the markets:

The markets are like an escalator going up,,,,

and an elevator going down

The speedy elevator downward causes the drawdown and great discomfort. So, at Mirador, we have developed ways to reduce volatility, and particularly drawdown, and hence provide a less volatile and a more comfortable investment experience.

What is Comfortable?

We all have different perceptions of comfort. Joyce likes the room temperature at 22C plus, and still sits with a heat pad or blanket, while I am quite content at 15C and walking outside at -5C with no coat!!! Investors have similar differences. The GIC quoted above has zero volatility – complete stability. That’s why the yield is so awful. But if that is the level of comfort you need to sleep well, then that’s a good alternative for you.

But if you want more yield, you need to accept more volatility. Mirador’s idea of comfortable stability is volatility and drawdown that is a fraction of the equity markets and lower or similar to our benchmark. The last several major bear markets have resulted in equity index drawdowns of approximately 30-60%. We target a drawdown in bear markets like this of approximately 15%. And we have done quite well at recovering from that drawdown.

So, if that seems comfortable enough or if you would like more information, call me at 403-718-0125 or visit our website; miradorwealth.com for more information about investing for high income and comfortable stability and wealth planning advice.