The Mirador Real Advice Blog

The Mirador Real Advice Blog is a bi-monthly publication with two purposes:

- There is no end to the results you get when searching for details regarding tax or investment-related rules and financial guidelines. We will help you find the actual source for such information, but more importantly, we will share successful advice we have given to clients regarding these topics.

- The markets are often a source of great concern AND opportunity. We will regularly make posts to alleviate your concerns and identify opportunities.

So If Bond Analysts Are So Smart, What Else Can We Learn From Them?

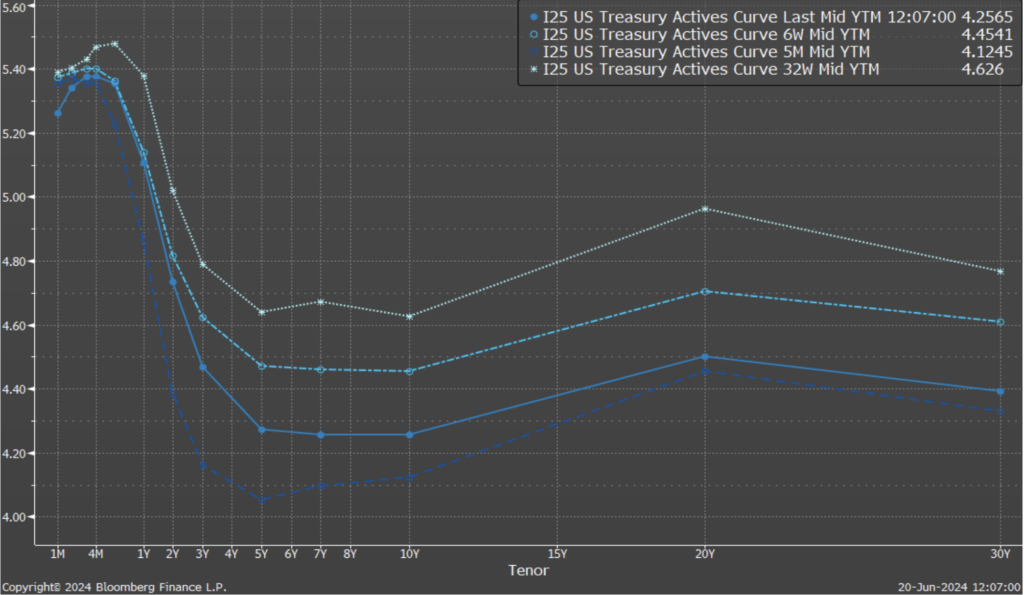

Mirador Real Advice Blog So If Bond Analysts Are So Smart, What Else Can We Learn From Them? August 22, 2024 In my last blog post regarding the yield curve, I talked about how huge and important the bond market is and how I believed this results in it attracting

Whats Most Important: The Overnight Bank Rate, or the Yield Curve?

Mirador Real Advice Blog What’s Most Important: The Overnight Bank Rate, or The Yield Curve? August 13, 2024 If you work for the mainstream media, or if their content is all you use, your answer to this question is likely the Bank Rate. If you have a mortgage, a corporate

Preparing for the Death of a Partner: It’s Always Good to Hope for the Best but Plan for the Worst

Mirador Real Advice Blog Preparing for the Death of a Partner: It’s Always Good to Hope for the Best but Plan for the Worst June 13, 2024 A client of ours had a friend who recently lost a spouse – it was very unexpected, and she found herself unprepared…unprepared to

Just One Thing… But Also Much More Than One Thing!

Mirador Real Advice Blog Just One Thing… But Also Much More Than One Thing! June 13, 2024 When I started in the investment industry over 30 years ago, we were encouraged to be everything to everyone; insurance agent, financial planner, investment manager, investment product specialist, and more. Additionally, we were

When Should I Apply for CPP?

Mirador Real Advice Blog When Should I Apply for CPP? May 28, 2024 Our answer? It depends… The standard retirement age to start CPP is 65. However, individuals may elect to start CPP as early as age 60 and as late as age 70. If one opts to start CPP

Should I Invest at a New High?

Mirador Real Advice Blog Should I Invest at a New High? The Importance of Momentum in Investing May 28, 2024 Back in the 1990s, there was a mutual fund company advertisement on television where a person was asking their investment advisor (mutual fund salesperson): “When is the best time to