Portfolio Update Report

Mirador Corporation Q3 Report 2024

October 31st, 2024

Dear Friends and Clients,

What an absolutely wonderful autumn season the Clarke family has had. The weather was as good as it gets –cool and sunny so you could work hard and be happy with no sweating. And the colours were fantastic and lasted longer than normal. And here I am in my office on the first day of snow, admiring the crisp blue sky over the clean white foothills. We are so blessed to live in such a beautiful province. I hope you and your family have enjoyed it as well.

This is the first time since I started the toy ranch project that I have felt totally ready for winter. All the feed is in place for the winter. I have expanded the electrical system. The heat lamps and heated water bowels are in place. I have a huge pile of firewood near the back door. All the equipment has had oil changes, maintenance, and repairs to be ready for what winter might throw at me. And we just filled the freezers with our first homegrown beef, and it is pretty darn tasty.

This latest quarter marked the transition to the next phase of the market cycle – short term interest rates started dropping, the yield curve inversion has started to shift to a more positive slope, and inflation is approaching the stated goals. All this with only a modest deterioration in company results, economic production, and the employment picture. Yields for the 2-30 year maturities have increased considerably recently. Also, the U.S. dollar has been very strong. This might be an indication that inflation may persist longer than anticipated which might slow down the short rate reductions. This all might be a result of the increased probability of a Trump win.

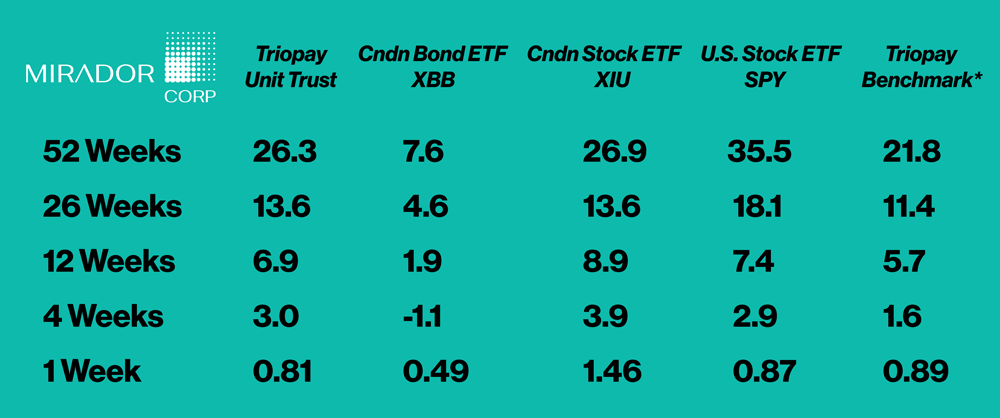

Your enclosed report is for Q3, but as I have said before, time is a continuum, so rolling returns are a much more valuable portfolio management metric. The Triopay programs have incredible results as you can see by the following rolling percent returns (returns for the weeks prior to last Friday October 18th, 2024:

* 40% XBB, 30 % XIU, 30% SPY

In summary, Triopay has outperformed its benchmark in all periods other than last week. Triopay has consistently outperformed most of the benchmark components in most periods. The exception is the U.S. market, which continues to outperform because of a handful of artificial intelligence related large technology companies with poor or no dividends.

Of course, the geopolitical issues persist:

Russia / Ukraine and the nuclear potential

Israel versus Hamas and related entities (also nuclear potential)

The November 5th U.S. election

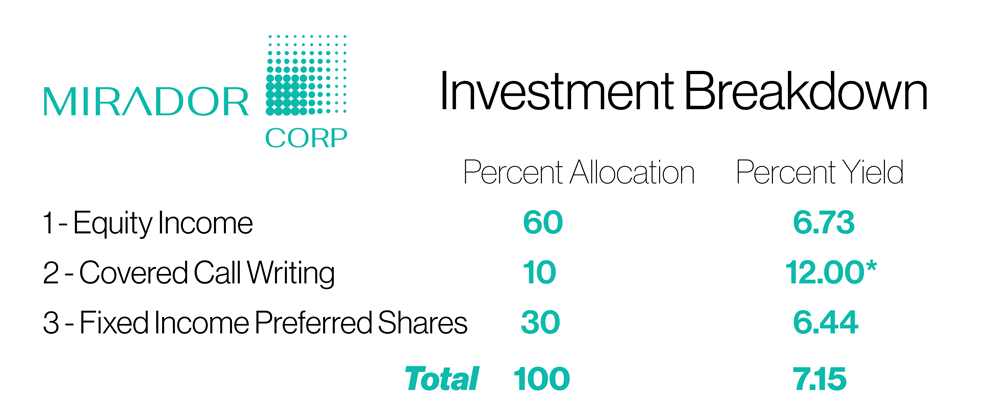

But there is always a collection of these issues yet somehow, we see the occasional volatility, and then life goes on with the markets. Of course, I am ready to protect your capital if next time is different. But until then, we remain fully invested as follows:

* Approximated using 4% call premium for 3 month dated calls, 4 times a year

Given the above, I am confident that 2025 will be another year with a very tax-efficient distribution above 7%. None of this was achieved using the infamous “buy and hold (hope)” approach. There have been roughly 210 trading days so far this year and we have completed 341 trades year-to-date:

- We have changed the asset mix substantially towards fixed income

- We exited the covered call writing (CCW) this summer and moved the money to the market exposure system when things became tenuous and the Neural Networks gave us the short signal.

- We moved back to CCW when the markets improved, focussing on low-dividend-yield commodity and technology companies for increased diversification – collecting call premiums rather than the dividends we collect with the Equity Income stocks

- We are always optimizing the yield per the percent allocation with our proprietary database and factor sorting system.

- We have used our technical indicators for trend following and mean regression combined with yield and the dividend factor models to trim and increase positions.

In the client services department, we are in the process of replacing our digital marketing consultant and that is why we have slowed down with blog posts. These will resume once we have a new consultant in place – hopefully in November. Since the last quarterly update, we did post two important blogs about interest rates and the yield curve – slightly more technical topics, but very important. Please visit the website to read these; Mirador Corporation

We are currently working on the tax status for Triopay to ensure we close out the year with the best possible after-tax results.

That’s it for Q3 2024. As always, phone or reply to this email to just say howdy, or if you have any questions comments or ideas. Graphical reports will resume when feasible – probably January. We are considering having an annual meeting like we did in the old days – a chance to have some cheers and appetizers and get caught-up socially and portfolio wise. We will let you know if we can go ahead with this in the New Year.

Sincerely,

Stan 403-608-4664

Joyce 403-978-6798